Namaskar, Over the last few years, I’ve read almost every book that exists on money and investing, from classic books like Rich Dad Poor Dad to psychology-focused ones like Think and Grow Rich to investing guides like One Up on Wall Street. Coming from a day job in investment banking, some of the things I learned really surprised me because they contradicted what I was taught at work. I’m curious to know if you share the same perspective. Below, I’m breaking down the key things I’ve taken away from all these books, sticking as close as possible to what I’ve learned.

1. Rich Dad Poor Dad: The Classic of Classics

Rich Dad Poor Dad by Robert Kiyosaki is the classic of classics, and I can definitely see why it’s so popular. It covers the foundations for finance and money that we don’t get taught in school. The book’s premise is based around the author’s two dads: his biological dad, who said to get a secure job, take the traditional path, and retire with a pension, and his best friend’s dad, a high school dropout who built a business empire and was all about independent thinking and buying assets that make money for you.

Key Takeaway: Assets put money in your pocket, like investments (stocks, shares, real estate, side hustles, businesses). Liabilities take money out and lose value over time, and you want to avoid those, especially when you’re building yourself up. Thinking of your home as a primary investment makes you buy a bigger house than you need, sucking up money in monthly payments that could’ve been used more profitably elsewhere. Every pound or dollar spent today is one that won’t work for you later, so give each one a purpose, like an employee working for you.

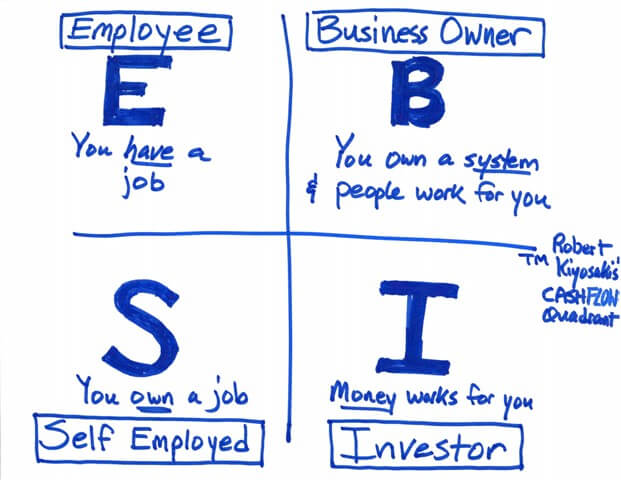

2. Cash Flow Quadrant: Don’t Rely on a 9-to-5

Kiyosaki’s follow-up, Cash Flow Quadrant, shows there are hundreds of ways to earn money beyond a conventional 9-to-5 job. Most people think a stable job is the only legit way to financial security, but this book paints a whole new picture. It makes you understand the limitations of a job and how relying purely on it might just be the worst thing you do for financial freedom.

Key Takeaway: The cash flow quadrant represents four ways to earn money: employee (9-to-5), self-employed (like a dentist or freelancer), big business owner, or investor. The book talks about how to use these paths to achieve financial freedom and which are most likely to get you there. It gets your mind ticking with ideas for earning outside a traditional job.

3. The 4-Hour Workweek: Work Smarter, Not Less

When I saw the title The 4-Hour Workweek by Tim Ferriss, I was skeptical—a four-hour workweek sounded too good to be true. But as I got deeper into the book, I realized it wasn’t about working less; it was purely about working smarter. It shows how anyone can live a retired millionaire lifestyle by building their own business, automating it, and collecting income while living their best life, not waiting years to retire.

Key Takeaway: Something that seems far-fetched is a lot more achievable than you think. Build a business, automate it, and collect income as you go. This book gives you the tools to make the ideas from Cash Flow Quadrant happen, showing you how to earn outside a traditional job setup.

4. The Millionaire Fastlane: Get Rich Quick, But It’s Hard Work

The Millionaire Fastlane by MJ DeMarco says there’s no such thing as get rich easy, but there is such a thing as get rich quick, which is interesting because you don’t hear that often. He talks about three paths: the Sidewalk (spending more than you earn, trapped paycheck to paycheck), the Slow Lane (safe job, saving, retiring at 65+), and the Fast Lane (leveraging time for passive income).

Key Takeaway: The Fast Lane is about investing time in work that generates passive income, like creating a product or system that earns long after your original time investment. It expands your income potential, but MJ keeps it real—it takes hustle, hard work, and discipline. It’s years of experience and knowledge that get you to that “quick” point.

5. Think and Grow Rich: Mindset Is Everything, But…

Think and Grow Rich by Napoleon Hill has people split—you either love it or hate it. Some say it’s all fluff and doesn’t deliver a clear roadmap to wealth, so they’re disappointed. Others say it transformed their mindset and financial lives, like a light bulb moment that helped them unlock limiting money beliefs.

Key Takeaway: Mindset is everything. If you have a scarcity mindset, thinking money’s hard to come by, that’s what you’ll experience. If you believe in abundance and that you’re capable of wealth, your actions align with success. But mindset alone isn’t enough—you need consistent, focused action. If you’re open to digging into your beliefs, this book’s for you; if you want a step-by-step guide, skip it.

6. The Psychology of Money: It’s More Than Math

I have a whole video on The Psychology of Money by Morgan Housel, so I’ll link that here. Money is as much about psychology as it is about math—our feelings, past experiences, and how we perceive money often overshadow raw financial knowledge. The most interesting part is how we misattribute luck in financial lives.

Key Takeaway: We study exceptional success stories like Bill Gates, thinking we can replicate them, but the more exceptional the story, the more luck played a role, and the fewer lessons you can apply. Focus on patterns, not people. Patterns like disciplined saving and investing work for everyone and don’t need luck. I’ve got a free guide on this—page 32 covers proven investing fundamentals, linked in the description.

7. The Intelligent Investor: Keep It Rational

The Intelligent Investor by Benjamin Graham is what Warren Buffett read at 19, and he still calls it the best investing book ever. Its principles are timeless. You don’t need specialist knowledge or deep insight—just two things.

Key Takeaway: Long-term investing needs a rational framework to make decisions and not letting emotions override it. It covers how the market behaves, basic finance fundamentals, and controlling your psychology to stay disciplined.

8. Girls That Invest: Beginner-Friendly Investing

Girls That Invest by my friend Sim is a really good book for the ultimate beginner. It covers why you should invest, the basics and terminology, and how to find your investing personality type.

Key Takeaway: Learn the basics of investing, understand your risk tolerance, and create a portfolio that matches it. This book makes investing approachable for anyone starting out.

9. The Little Book of Common Sense Investing: Index Funds Rule

The Little Book of Common Sense Investing by John Bogle, Vanguard’s CEO who invented index funds, argues that the winning strategy for beginners is simple—invest in index funds indefinitely.

Key Takeaway: Index funds outperform most alternatives because of low costs and broad market exposure. Bogle’s asset allocation (stocks to bonds) is a bit conservative and outdated, so follow up with books like The Dhandho Investor or One Up on Wall Street.

10. The Dhandho Investor and One Up on Wall Street: Invest in What You Know

The Dhandho Investor by Mohnish Pabrai and One Up on Wall Street by Peter Lynch say the best investments are often right under your nose, in things you know and engage with daily. I had Invisalign five years ago, loved the product, researched the company, and bought their stock—it’s my biggest return ever.

Key Takeaway: As a customer, you have an advantage over Wall Street pros by investing in companies you understand, but it’s not just about being a customer—you need to research thoroughly before investing.

11. Ignorance Debt and Investing in Yourself

Alex Hormozi’s concept of “ignorance debt” applies to investing—the difference between where you are and earning millions is just information you haven’t learned yet. Beginners often think they know more than they do, which can mislead them without a strong foundation. Also, most money books don’t mention this, but investing in yourself comes first.

Key Takeaway: Before the stock market, invest in your ability to manage money or make more through a business or side hustle. It’s harder work but more impactful in the short term than the slow game of investing. I’ve got a playlist on this, linked here.

Summary Table: Key Lessons from Money and Investing Books

| Book/Concept | Key Lesson | Core Insight |

|---|---|---|

| Rich Dad Poor Dad | Assets vs. Liabilities | Buy assets (stocks, real estate, side hustles) that put money in your pocket, avoid liabilities that drain it. Don’t see your home as a primary investment. |

| Cash Flow Quadrant | Beyond the 9-to-5 | Four ways to earn: employee, self-employed, business owner, investor. Move toward business or investing for financial freedom. |

| The 4-Hour Workweek | Work Smarter, Not Less | Build and automate a business for passive income to live your best life now, not waiting for retirement. |

| The Millionaire Fastlane | Fast Lane to Wealth | Create passive income systems (products, businesses) with hustle and discipline for quicker wealth-building. |

| Think and Grow Rich | Mindset + Action | An abundance mindset aligns actions with success, but you need consistent action to make it work. |

| The Psychology of Money | Focus on Patterns | Exceptional success often involves luck; focus on proven patterns like disciplined saving, not outliers like Bill Gates. |

| The Intelligent Investor | Rational Investing | Use a rational framework and emotional discipline for long-term investing success, no special knowledge needed. |

| Girls That Invest | Beginner Investing | Learn investing basics, find your risk tolerance, and build a portfolio that matches your goals. |

| The Little Book of Common Sense Investing | Index Funds | Invest in index funds for low-cost, effective wealth-building, but consider modern allocation strategies. |

| The Dhandho Investor / One Up on Wall Street | Invest in What You Know | Invest in familiar companies after thorough research, leveraging your customer experience for an edge. |

| Ignorance Debt / Invest in Yourself | Learn and Grow | Bridge ignorance with knowledge; invest in your money management and earning skills for faster results. |

FAQs

What’s the main lesson from Rich Dad Poor Dad?

It’s about assets (like stocks or side hustles) putting money in your pocket and liabilities (like cars) taking it out. Avoid thinking your home is a primary investment—it can trap your money.

How does Cash Flow Quadrant change your view on jobs?

It shows a 9-to-5 job limits financial freedom. The four ways to earn—employee, self-employed, business owner, investor—push you to explore business or investing for more freedom.

Is The 4-Hour Workweek really about working four hours?

No, it’s about working smarter by building and automating a business to generate passive income, so you can live your dream life now, not after years of waiting.

What’s the “Fast Lane” in The Millionaire Fastlane?

It’s creating passive income systems, like products or businesses, that earn long after your work. It’s “get rich quick” but needs years of hustle and discipline.

Does Think and Grow Rich give a clear wealth plan?

No, it’s about mindset—believing in abundance over scarcity. It helps unlock limiting beliefs but needs action to work, not just positive thinking.

Why focus on patterns in The Psychology of Money?

Exceptional success stories often rely on luck, which you can’t copy. Patterns like disciplined saving and investing are reliable and work for everyone.

Who should read The Intelligent Investor?

Anyone wanting a timeless, rational approach to investing. It teaches a decision-making framework and emotional control, no genius required.

How does Girls That Invest help beginners?

It explains why to invest, basic terms, and how to find your investing personality to build a portfolio that fits you, perfect for newbies.

Why does The Little Book of Common Sense Investing love index funds?

Index funds are low-cost and outperform most options for beginners, but Bogle’s stock-bond allocation might be too conservative, so check other books.

How do I invest in what I know, per One Up on Wall Street?

Use your experience as a customer to spot good companies, like I did with Invisalign, but do deep research before buying their stock.

Why invest in myself before the stock market?

Investing in your money management or earning skills, like starting a side hustle, gives quicker results than the slow game of stock market investing.

Anshu Pathak is a passionate writer and avid reader whose love for stories shapes her world. With a heart full of imagination, she weaves tales that resonate with emotion and depth. When she’s not crafting her next piece, you can find her lost in the pages of a novel, exploring new worlds and perspectives. At Moodframe Space, Anshu shares her creative journey, offering insights, stories, and reflections that inspire and connect with readers everywhere.